A new Logistical Memorandum of Understanding (MoU) between Transnet Freight Rail and Imperial Logistics is set to drastically reduce costs of logistics for cargo owners, the companies exclusively told Cape Media journalist, Farai Diza, at a launch late last week.

Transport plays a pivotal role in South Africa as it enables the country to achieve economic growth. The transport industry does not only facilitate the movement of freight and people, it also employs a great number of individuals and forms a major part of South Africa’s GDP.

It is not a secret that fuel costs dampen the profitability of many companies as they increase the transportation of goods hence the transportation sector is always searching for innovative and efficient solutions of curbing major cost components of all supply chains.

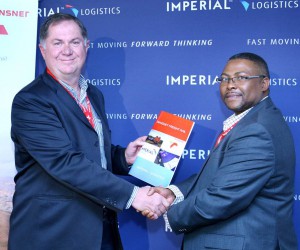

Transnet Freight Rail (TFR) and Imperial Logistics recently signed an MoU that will reduce the adverse impact of rail friendly freight on the national road infrastructure and reduce the costs of logistics for cargo owners throughout Southern Africa.

The agreement comes after exactly four years of engagement between the freight and logistics firms. The MoU will divert freight that is currently transported by road to a multimodal transport combination and amplify the use of rail in long-haul transportation.

TFR is driven with aspirations of becoming one of the top five best railways in the world by 2019 and they have further enhanced those aspirations by casting their nets even wider. The large corporate owns and maintains a network of over 20 500 route kilometers.

Imperial provides logistics services with extensive operations throughout Europe and Africa and by working with TFR, the company will aim to maximise road and rail logistics capabilities to reduce road congestion and greenhouse gas emissions and lower transport costs for its customers.

Considering that transporting goods in Africa is currently more than 80% on road, the shift to rail will benefit passengers and greatly reduce the overuse of roads.

The agreement is aimed at exploring multimodal collaboration opportunities within the logistics and transport sector. The companies aim to leverage road and rail logistics capabilities and address other externalities such as road congestion, road accidents, and greenhouse gas emissions and to lower the cost of doing business for customers.

The initiative brings together TFR efficiency in long haul rail transportation with Imperial Logistics’ road freight logistics, distribution and end to end value chain management expertise. This breakthrough partnership will facilitate joint development of multi modal logistics services in support of Transnets road to rail strategy.

“The MoU makes it possible for TFR and Imperial Logistics to collaborate to benefit the South African economy through resolving previous competitive obstacles. This is a significant move by TFR as both parties intend to support these projects. We will do this by facilitating our unique expertise and experience and access to the knowledge of our highly qualified and specialised business divisions,” laments TFR chief executive, Siyabonga Gama.

Given the dominance of road freight, a key question is what needs to be done to shift bulk transportation demand to rail. Transnet has conducted extensive research and public engagement to plan for future freight transport capacity requirements.

Gama believes that this has been consolidated into the Transnet National Infrastructure Plan which forms an important part planning process.

“It will also drive regional integration, particularly in Southern Africa. The development of private-public partnerships will spread risks and enable growth of local industry peripheral to the rail industry, promoting skills and job creation. TFR and Imperial logistics have the opportunity to make a difference through their combined efforts,” he adds.

Gama has been at the helm of TFR since 2005 and has steered the company growing from a loss making division to the highest contributor of revenue for the Transnet group. He has also played a critical role in developing the African Railway industry in a number of ways.

He further stated that the collaboration with TFR would benefit the wider economy by tackling competitive obstacles and cutting down on transport costs which will prove futile.

“We are currently cooperating across several projects with a view to reducing the cost of doing business in South Africa by diverting goods to cheaper rail transport and developing a mutually beneficial logistics hub. This agreement will further enable Imperial access to Transnet held property close to major rail hubs on which the logistics group would be able to develop the required warehousing infrastructure,” he stipulates.

During the 2013 financial year, the Transnet group moved 69.2 million tons of coal along the export channel, a lower than expected increase from the 67.7 million railed in 2012. Softer coal prices reportedly dampened demand, while TFR also experienced operational problems at the Overvaal tunnel.

The importance of the transport industry necessitates that the industry is operated efficiently and effectively. As transportation costs are not the only factor that companies consider when making a modal choice decision, many companies within South Africa have been moving their goods off rail and onto road.

TFR and Imperial logistics aim to divert freight currently transported via road to multi modal combinations with the promise of a more efficient and cost effective end to end solution. The two companies intend to join forces in order to target existing volumes within their groups across various industries.

The collaboration comes at an opportune time as the overuse of roads and highways is damaging the road infrastructure and as transport companies may face the added cost of e-tolls.

The agreement comes at a time when Imperial increased its revenue in its logistics businesses to R34 billion for the financial year ending 30 June 2013, achieving a hefty 21% growth.

The European and African divisions contributed almost equally with revenue from Africa countries outside South Africa contributing almost 15% to total revenue. Within South Africa, Imperial Logistics recorded a revenue growth of 12.4% and operating profit growth of 21.4% for the second half of the financial year.

“We have simplified our South African business through consolidation of core expertise thus leveraging scale, synergies and best practice across businesses to further improve our service offerings to our clients. During the last year, we have gained multiple new contracts, many of which with leading multi nationals across the industry spectrum. We also expanded our engagements with various businesses,” says Cobus Russouw, chief integration officer of Imperial Logistics.

“We are very excited about the structured way in which we can now engage with TFR as a partner to service our customers. We are uniquely placed to partner companies in leveraging the value inherent in their supply chains. We have been informally doing this for years. While these are two companies that would traditionally have competed, this agreement is significant as it prevents Imperial from putting the wrong product on rail and enables our respective services to complement one another,” he added.

The partnership is in line with Transnets Market Demand Strategy and Imperial Logistics multimodal logistics strategy, both of which aim at improving logistics efficiency to benefit industry and the South African consumers that are serviced by it.

According to Gama, the possibility of developing large scale intermodal hubs at transport cores such as Durban, Cape Town and Port Elizabeth. He, however, quickly pointed out that TFR is not trying to eliminate road transport but is merely trying to increase freight volume.

“We are not trying to make road transport extinct but we are trying to increase freight volumes and decrease the volumes of goods carried on our roads. Having said that, there are certain things that rail will never be able to do. The planned integration of road and rail capacity will not culminate in the long term exclusion of road as a viable freight medium,” he notes.

Earlier in July, TFR signed a MoU with Kirilo Savic Institute (KSI) aimed at exploring possible collaboration opportunities within the railway and transportation sector globally. KSI is a Serbian company whose activities are mostly related to the field of mechanical engineering, traffic and transport as well as municipal infrastructure.

But the ratifying of the partnership with Imperial will facilitate the joint development of multimodal logistics services in support of Transnet’s road to rail strategy which aims to reduce the volume of rail friendly freight transported on national roads countrywide.

Imperial logistics is uniquely placed to in leveraging the value inherent in supply chains and the multi modal logistics agreement will unlock the competitive advantage contained in complex and dynamic logistics environments.

“As a multi branded business, we are in a position to optimise the benefits, scale and synergies that are derived from large businesses, while ratifying agility, customer focus and an entrepreneurial flair that characterises smaller businesses. We apply our pre eminent supply chain management skills to manage operational processes across end to end value chains of behalf of clients,” points out Russouw.

Last year TFR were presented with a gold award at the 24th Logistics Achievers Awards for the firms’ logistics excellence in dynamic scheduling optimisation while Imperial got a bronze award for logistics achievement in preferential procurement optimisation.

At last count, from a range of sources, emissions from transport in South Africa account for at least 12% of South Africa’s total greenhouse gas emissions that cause global warming. Significantly about 87% of this is from the combustion of diesel and petrol on our roads. Trends show that transport emissions are the fastest growing and it was not surprising that the integrated logistics agreement was also hailed by leading environmentalist Louise Naude.

“In the freight sector we are researching the emissions per commodity per mode, such as moving coal on trains or food stuffs on trucks. Our main aim will be on emissions reductions options for food logistics nationally and the consequences for jobs and developmental issues like food security. Instead of Imperial regarding the future road to rail transition as a threat, they are looking to create an opportunity from it. Which is precisely the kind of synergy we want to encourage,” states Naude who heads up the WWF Nedbank Green Trust Transport Low carbon Frameworks Programme.

TFR is the largest division of Transnet. It is a world class heavy haul freight rail company that specialises in the transportation of freight. The company maintains an extensive rail network across South Africa that connects with other rail networks in the sub Saharan region with its rail infrastructure representing about 80% of Africa’s total.

The average age of Transnet Freight Rail’s fleet is 37 years. Just 11% of South Africa’s inland freight is moved by rail against 89% by road, according to last year’s state of logistics survey conducted by the Council for Scientific and Industrial Research and Imperial logistics.

“South Africa must address critical issues relating to the road freight sector, shift freight from road to rail and address rampant skills shortages. High toll costs which are meant to ensure road infrastructure provision and maintenance result in steeper operating costs and inflation. South Africa’s freight transport sector relies heavily on road transport. This means the transport of bulk mining commodities such as coal and manganese and also fast moving consumer goods, over long distances, is damaging South Africa’s roads especially the corridors between Gauteng and Durban and Cape Town,” thinks Nadia Viljoen of CSIR

According to the Department of Transport, between 2003 and 2007 the volume of freight in South Africa more than doubled. Over the next three years the government will invest R262 billion to improve transport and logistics infrastructure with the bulk of it to be undertaken by state owned companies such as Transnet.

To succeed in moving a significant proportion of goods from road to rail transport will require a dynamic shift in the way Transnet interacts with customers, greater attention to branch lines and investment in engineering, ports and rail operational skills.

The agreement will further enable Imperial access to Transnet held properties close to major rail hubs on which the logistics group would be able to develop the required warehousing infrastructure.

“Imperial brings its road logistics expertise. If you combine that with Transnet’s expertise in long haul and parcel management, the customers are going to see a very big product. A key aspect of the deal is to develop the inland market. The tendency has always been inland to port but we can now do inland to inland,” points Gama.

The partnership is in support of South Africa’s National Development Plan of ensuring that all South Africans attain a decent standard of living through the elimination of poverty and reduction of inequality through safe and reliable public transport.

Farai Diza